And now, the latest in, “Does this building ever stop?” The co-op at 2006 Washington Street in Pac Heights knows how to make headlines: Basically, just keep pumping its prices higher. This is not a fool-proof system, but it works at least this well, because we’re returning to these heights once again with a new … Continue reading San Francisco’s Most Over-the-Top Condo Wants $30M

Tag: condo

Shipyard Condo Sells for Half Million, Instantly Goes Back Up For Sale

Some homes you just can’t bear the thought of parting with. But 550 Innes Avenue #101 is evidently not one of them, at least not in the eyes of the guy who just bought it. This one bed, one bath Shipyard condo just sold three days after Christmas for a tidy $525,000 (about normal for … Continue reading Shipyard Condo Sells for Half Million, Instantly Goes Back Up For Sale

Maximum Luxury: Big-Time East Cut Building Finally Makes Big Sale

Welcome back to Maximum Luxury, the weekly column where we peer at some of San Francisco’s most expensive homes, just for the heck of it. Ordinarily we feature listings still on the market in this space, but sometimes a unit we’ve had our eye on up and sells out from under us before we can … Continue reading Maximum Luxury: Big-Time East Cut Building Finally Makes Big Sale

Demystifying SF’s Tenancy-In-Common Condos

Imagine you’re browsing SF home listings and you stumble across a comfy looking condo that for some reason is priced markedly below even similar units in the same neighborhood. And it’s branded with some mysterious letters: “TIC.” What to make of this conundrum? Even those who have already gotten their feet wet buying and selling … Continue reading Demystifying SF’s Tenancy-In-Common Condos

What Kind of SF Home Can You Buy For Less Than $500K?

It seems like it must have been another lifetime when you could buy a home in San Francisco for a mere $500,000. But in fact this was a commanding sum in the SF market until very recently, before the housing boom rewired our brains to imagine SF homes as exclusively seven-figure properties. Admittedly, you have … Continue reading What Kind of SF Home Can You Buy For Less Than $500K?

San Francisco Market Report

Britain’s June vote to exit the EU has already had an impact on the market in the US, including here in San Francisco. Mortgage rates have dropped almost a quarter of a percent, making the monthly payments on our pricey housing slightly more affordable. The result is that it will support continuing increases in sales … Continue reading San Francisco Market Report

May 2016 Central San Francisco Market Conditions

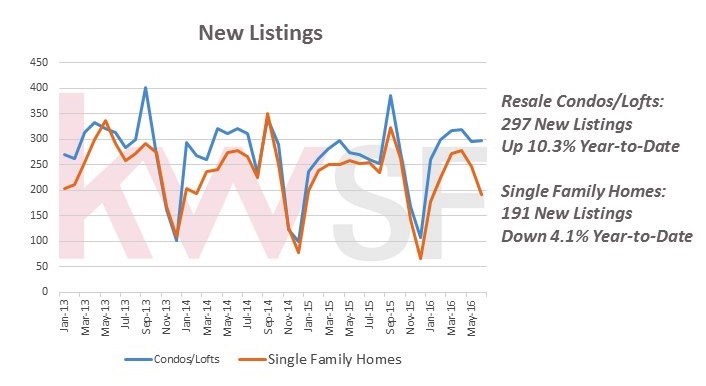

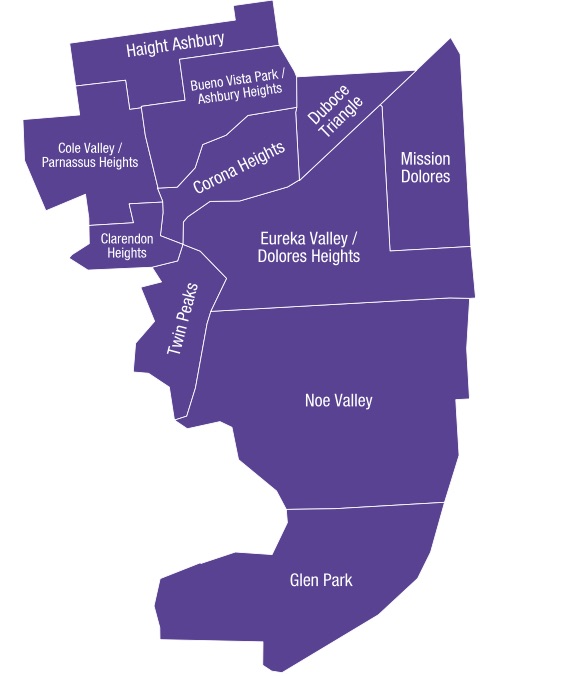

District 5’s (See SF Districts Map Here) April numbers continue their strong upwards trend with their highest ever median sales price of $2,287,500. Year-over-year, the median price is up 8.9%. Resale Condo/Loft Median Prices Resale condo-loft median prices have resumed the downward trend that started last September with a brief uptick in January and February. … Continue reading May 2016 Central San Francisco Market Conditions

May 2016 Market Report | San Francisco

We saw first quarter median Single Family Home prices in San Francisco jump with their biggest percentage increase (5.6%) in a decade, and in April’s numbers continue this strong upwards trend. The median price in San Francisco was $1,380,000 in April, the highest ever, and a 4.5% increase over March (yikes!). Resale Condo/Loft Median Prices … Continue reading May 2016 Market Report | San Francisco

Pacific Heights Co-Op Asks $4.2M Gets $3.8M, And Those Views…

Some things just never get old (like me), and some things never go out of style, like 2170 Jackson #3, which clinched this week’s top spot on our Underbid list by selling 10.59% under it’s $4,250,000 asking price at a cool $3,800,000. I can hear you all gasping either sighs of relief, gasps of ahhh, … Continue reading Pacific Heights Co-Op Asks $4.2M Gets $3.8M, And Those Views…

Golden Gate Heights Fixer Sells $455,000 Under Asking, But Still $1.9M

Hey! We’re back. What a great vacation (in Hawaii), and great to see even when I’m surfing, you’re all still browsing. So, on with the show… Monday was a travel day, so Tuesday is all about the Underbid, and this week a sweet little fixer with amazing carpeting, staging, painting, and lighting (Oh yeah, there … Continue reading Golden Gate Heights Fixer Sells $455,000 Under Asking, But Still $1.9M

New Construction Condo Prices Up, Resale Condo Prices Down

SAN FRANCISCO NEW CONSTRUCTION CONDOMINIUM PRICES DECLINED 1 PERCENT FROM PREVIOUS MONTH, UP 2 PERCENT FROM A YEAR AGO. RESALES PRICES DECLINED 10% FROM PREVIOUS MONTH, DOWN 6 PERCENT FROM A YEAR AGO. Though San Francisco pricing dropped for the fifth consecutive month, contract absorption at new developments indicates that the 2016 selling season is … Continue reading New Construction Condo Prices Up, Resale Condo Prices Down

For Sale | Luxury Top Floor SOMA Condo | $1,095,000

Top floor, luxury, view two bedroom, two bath condominium in a boutique elevator building with parking, situated in the vibrant SOMA District of San Francisco.

Maximum Underbid | Russian Hill Property Wins | List $3.2M, Sold $2.6M

Closed on the last day of 2015 was this 3 bedroom Russian Hill condominium with dramatic views. Listed for just shy of $3.2M and sold 18% under asking, at $2.6M, it takes top spot on the top 10 Podium Underbids of the week for San Francisco. Interesting to note is that out of the top … Continue reading Maximum Underbid | Russian Hill Property Wins | List $3.2M, Sold $2.6M

$440,000 Under Asking | Personal Chapel Maybe Included, Wallpaper Definitely

It only took seven months, but in the end, it got there. SOLD for $440,000 UNDER asking! You read that correctly, this 6-bedroom single family home in Mission Terrace at 100 Delano Avenue just closed $440,000 below the original (back in March) asking price of $1,600,000. After a price chop to $1.5, then $1.4, then … Continue reading $440,000 Under Asking | Personal Chapel Maybe Included, Wallpaper Definitely

August Case-Shiller Index | San Francisco Bay Area

The new S&P Case-Shiller Index for August was just released on Tuesday. The prices for homes in the upper third of prices – which dominate in most of San Francisco, central and southern Marin, and central Contra Costa – ticked down a tiny bit in summer, exactly as they did last summer. These short-term fluctuations … Continue reading August Case-Shiller Index | San Francisco Bay Area

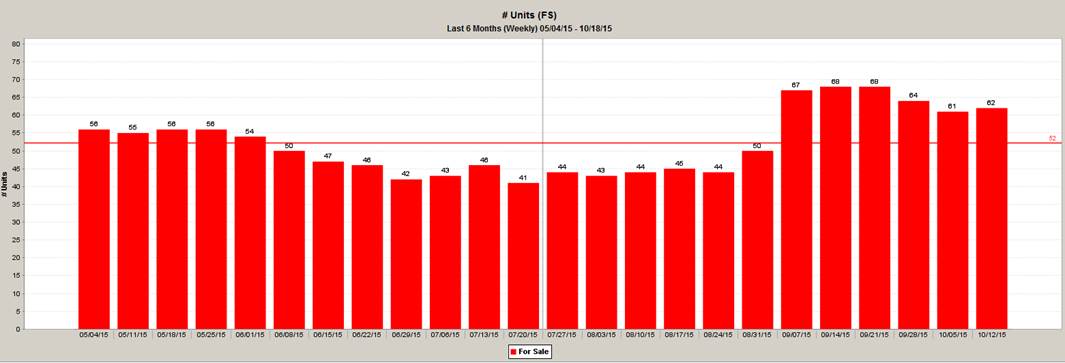

Active Listings By Price Segment and Property Type

These Broker Metrics charts track weekly number of Active Listings over the past 6 months (early May to mid-October): SFD, under $1m Active Listings – weekly inventory just below 6 month average, about same level as spring, lowest number of active listings since early July. Condo, under $1m Active Listings – autumn inventory levels well … Continue reading Active Listings By Price Segment and Property Type